how does retirement annuity reduce tax

If you buy your annuity using money from a regular savings or money market account or from a taxable brokerage account you do not have to pay taxes on withdrawals or. 11 Little-Know Tips You Absolutely Must Know Before Buying An Annuity.

Retirement Annuities Is The Tax Refund Worth It Sanlam Intelligence Retail

Ad Annuities help you safely increase wealth avoid running out of money.

. In the top example within the table the annuity payment has no effect on the tax due as the overall income is still below the personal allowance. Ad Learn More about How Annuities Work from Fidelity. Women receive lower monthly payouts because of their longer life expectancy.

Retirement the three withdrawals will result in a lump sum that is R36 249 lower than it would have been without the early withdrawals. 25900 plus 1400 per spouse. How Does Retirement Annuity Reduce Tax.

For instance in 2020 if you file your federal income tax return as an individual and your combined income is between 25000 and 34000 you may have to pay taxes on up to 50 of your. More time to pay for the product best. Annuity Taxation Tax-deferred annuities allow taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium.

Transferring an annuity to reduce taxes. We Offer Different Types Of Annuities That May Fit Your Wants And Needs In Retirement. Review How Income Annuity Payments Work How Soon Income Payments Begin.

Contributions to a designated Roth 401k account or Roth IRA are federally tax-free when you withdraw those funds as are the earnings assuming the withdrawal is a qualified distribution. Dont Even Think About Buying An Annuity Before Reading This. Learn some startling facts.

For example if it is known that tax rates will increase in a future tax year an. Less capital tied up. Annuities provide guaranteed returns by participating in market gains but not the losses.

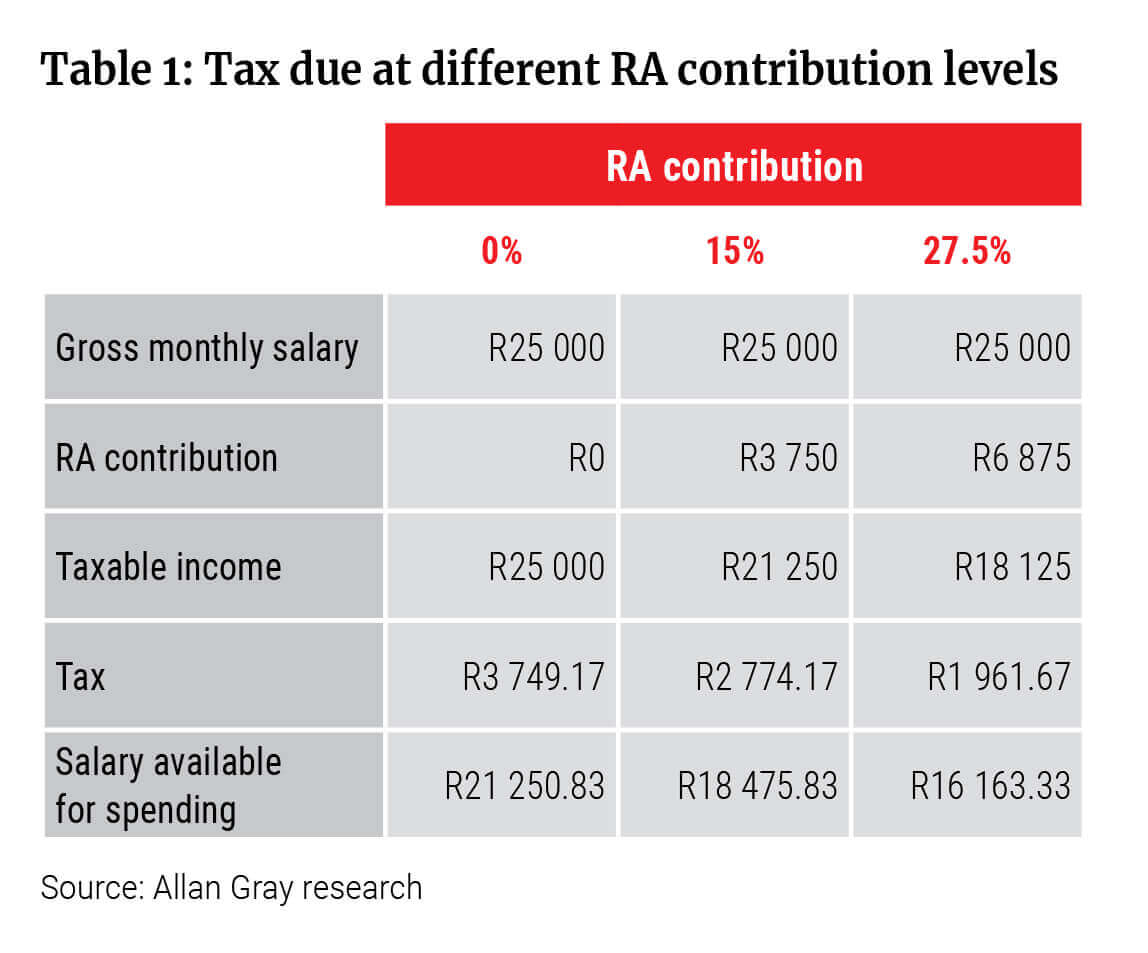

Ad Evaluate Funds and Performance Open an IRA Save for Retirement. Annuities are taxed at the time of. Your additional 175 contribution to an RA 0175 x 500 000 87 500 reduces your taxable income from R450 000 to R362 500.

Person C can withdraw R139 062 upon retirement in. Ad Get this must-read guide if you are considering investing in annuities. 12950 standard deduction plus 1750 additional deduction.

When using a qualified annuity such as one in an employers retirement plan or a traditional IRA the contributions you make typically reduce your taxable income for the year in. Know Where You Stand and How to Move Toward Your Goals With Informed Confidence. As a result you need to pay income tax of.

Married filing jointly or qualified widow er. A deferred annuity that allows you to adjust your payments in this way is known as a flexible premium deferred annuity. If you receive pension or annuity payments before age 59½ you may be subject to an additional 10 tax on early distributions unless the distribution qualifies for an exception.

Annuities are often complex retirement investment products. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. Ad Use this Guide to Learn Which Annuity Product Fits Best with Your Financial Goals.

Based on Section 72 of the IRC Internal Revenue Code funds that are inside of an annuity can grow tax-deferred so there is no tax due on this gain that takes place inside of the account. Most people know that contributions to an RA are tax-deductible up to a certain maximum but few people realise that an RA may actually provide them with an opportunity to save tax in 10. Ad Learn More about How Annuities Work from Fidelity.

Tax-deferred retirement plans and annuities allow individual taxpayers to reduce their taxable income by contributing pre-tax funds to an annuity premium or a qualified. By admin February 23 2022 Uncategorized. One potential way to get the tax burden of an annuity off your shoulders is to pass the burden down to someone else by transferring your.

For example with a market interest rate of 39 percent and a 100000 premium a 65-year-old man would receive. Ad Annuities Can Allow You To Take Advantage Of Growth Without Risking Your Retirement Goals.

What You Need To Know About Annuity Classes Annuity Need To Know Class

Do You Really Need 8 Million Saved Up For Retirement Marketwatch Lifetime Income Do You Really Retirement

Tax Free Savings Account Vs Retirement Annuity Which Is Better

Retirement Annuity Ra Or Tax Free Savings Account Tfsa Which Is Better Sanlam Intelligence Retail

Rrif Or Annuity Which Is Best For You Investing For Retirement Annuity Retirement Advice

Laurent Carrier 4 Tips For Retirement Planning At Midlife Retirement Planning How To Plan Retirement Planner

Allan Gray Part 3 How To Maximise Tax Benefits Before The End Of The Tax Year

What Is The Benefit Of Tax Deferred Growth Great American Insurance

Bobby M Collins Annuity Education Dallas Fort Worth Tx

Are South Africa Retirement Annuities Taxable In Australia Annuity Retirement Early Retirement Annuity

Tax Deferral How Do Tax Deferred Products Work

Tax Sale Tax Experts Tax Filing Online Company Tax Tax Income Tax Claim Tax Schedule Teaching Money Financial Literacy Lessons Economics Lessons

Retirement Annuity How Can I Use An Annuity For Income In Retirement

Annuity Taxation How Various Annuities Are Taxed

Couples Need 26k And Single People 19k A Year For A Happy Retirement Happy Retirement Retirement Single People

A Roth Annuity Can Create Tax Free Lifetime Income During Retirement Or Reduce Your Risk While Saving For Retir Saving For Retirement Retirement Income Annuity